To call Gaurav Munjal and Roman Saini a second seismic shift in India’s edtech ecosystem — after the BYJU’S downfall, of course — would be no exaggeration.

BYJU’S and Unacademy were spoken of in one breath, but both seem to be facing an uncertain future now.

Amid the reports of the exit of the two cofounders who built the decade-old edtech giant, nobody within the inner circles of Munjal and Saini seems to be surprised.

“Munjal is squarely focussed on Airlearn only for more than a year now, whereas Saini had long back lost interest in taking Unacademy forward,” insiders aware of the developments at Unacademy told Inc42.

Munjal and Saini each hold 3.4% stake in Unacademy, whereas the other cofounder Hemesh Singh, who moved on from Unacademy to an advisory role in 2024, holds 2.2% stake.

Sources claimed that both Munjal and Saini received cash payouts at the time of their exits and that they will have partial stakes in the Unacademy.

Additionally, Shashank Murali, Munjal’s confidante and the TapChief cofounder who sold his startup to Unacademy in 2021 for INR 25 Cr, is also moving on with Munjal . Murali had taken over operations at Unacademy’s Relevel after the acquisition, but Relevel itself seems to have been shut down as indicated by a dysfunctional website.

Multiple queries sent to Unacademy remained unanswered at the time of publishing this story.

The story will be updated if and when the company responds.

While in the days ahead, the industry will be buzzing with speculation and forecasts on what led to Munjal and Saini’s exits, sources in the know tell us that this has been in the making for almost a year. Munjal is said to have signalled to the board that he can no longer commit to leading Unacademy’s offline tuition centre business which contributes to 40%-50% of the company’s revenues.

Insiders also revealed that Munjal wanted to return to a tech-first edtech model, where Airlearn is the latest bet from the serial entrepreneur.

Munjal has handed over the reins to Sumit Jain, a board member, and founder of Commonfloor. Jain was leading the company’s Graphy app till the transition to the CEO post.

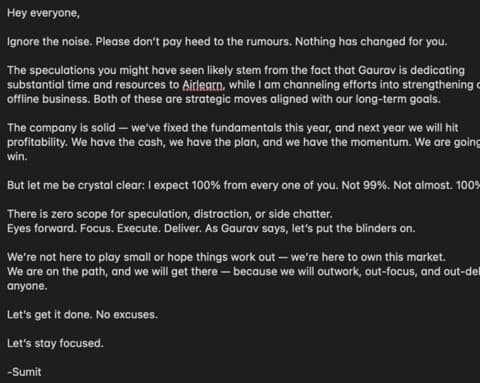

In an internal mail to Unacademy’s employees, Jain said the company operations will be running smoothly and that employees should not listen to the noise around the exits.

Besides Munjal’s own disinterest in taking Unacademy forward, there have been several other challenges plaguing the edtech unicorn. The exit of key leaders from 2023 onwards, which continued all the way to 2025 had forced the company on the backfoot too.

Plus, Unacademy and Munjal’s efforts to sell off the company at a $800 Mn-$1 Bn valuation to potential acquirers such as Allen Career Institute or K-12 Techno Services also did not materialise. But the feeling in the edtech industry was that Munjal was “desperate” to move on from the business, especially as the game had totally changed after the transition towards the hybrid or offline-first model.

Indeed, most of the $440 Mn raised by Unacademy at a $3.4 Bn valuation went towards scaling up its learning platform, before the transition to Unacademy Centres in 2021. The company has investors such as Temasek, Mirae Asset, SoftBank, General Atlantic, Peak XV Partners, Tiger Global on its cap table as of today.

“It is not that offline centres are not making money for Unacademy. However, look at the business models that Munjal has encouraged for Unacademy’s verticals in the past. He is not meant to lead a operations-heavy offline learning business, and is more keen on product-driven models. It was a rude shock to him when the online test preparation core business began to flatten post 2021, and Unacademy was forced to venture into offline business,” a former Unacademy CXO told us.

Whether Munjal had the board and investor’s consensus with him when he and Saini decided to part ways is unclear. We posted this question to various investors in the company, but did not receive any response.

Peak XV Partners, which has a 13% stake in Unacademy declined to comment. Blume Ventures, which owns 5% of the company, did not offer a substantive response either.

“It seems strange that the some of the big VCs who are the Unacademy shareholders list would not have seen this coming, particularly when one of the major investors was helping Munjal stitch together an acquisition pitch to other coaching giants and edtech companies,” according to a partner whose Bengaluru-based fund has invested in Unacademy.

Even as Munjal was camping in the US to think about his next chapter, and even as he tried to crack an acquisition deal in 2024, Unacademy saw offline learning revenue decline last year. PhysicsWallah is preparing for an IPO, and in the wake of the problems for Unacademy and BYJU’S, PW seems to have capitalised on the vaccuum in the market.

A Reality Check For Unacademy & Gaurav MunjalUnacademy’s growth trajectory for FY25 is not clear. Munjal posted on social media last year with some hints about revenue milestones, margins, cash flow at Unacademy, but these numbers for FY25 are not backed by filings.

In FY24 Unacademy reported a to INR 716 Cr from INR 733 Cr in the previous fiscal year, whereas the edtech firm trimmed its losses by 82.09% to INR 285 Cr in FY24.

Whereas media reports claimed that offline tuition centres contributed 40% of Unacademy’s revenues, sources claimed it is substantially higher.

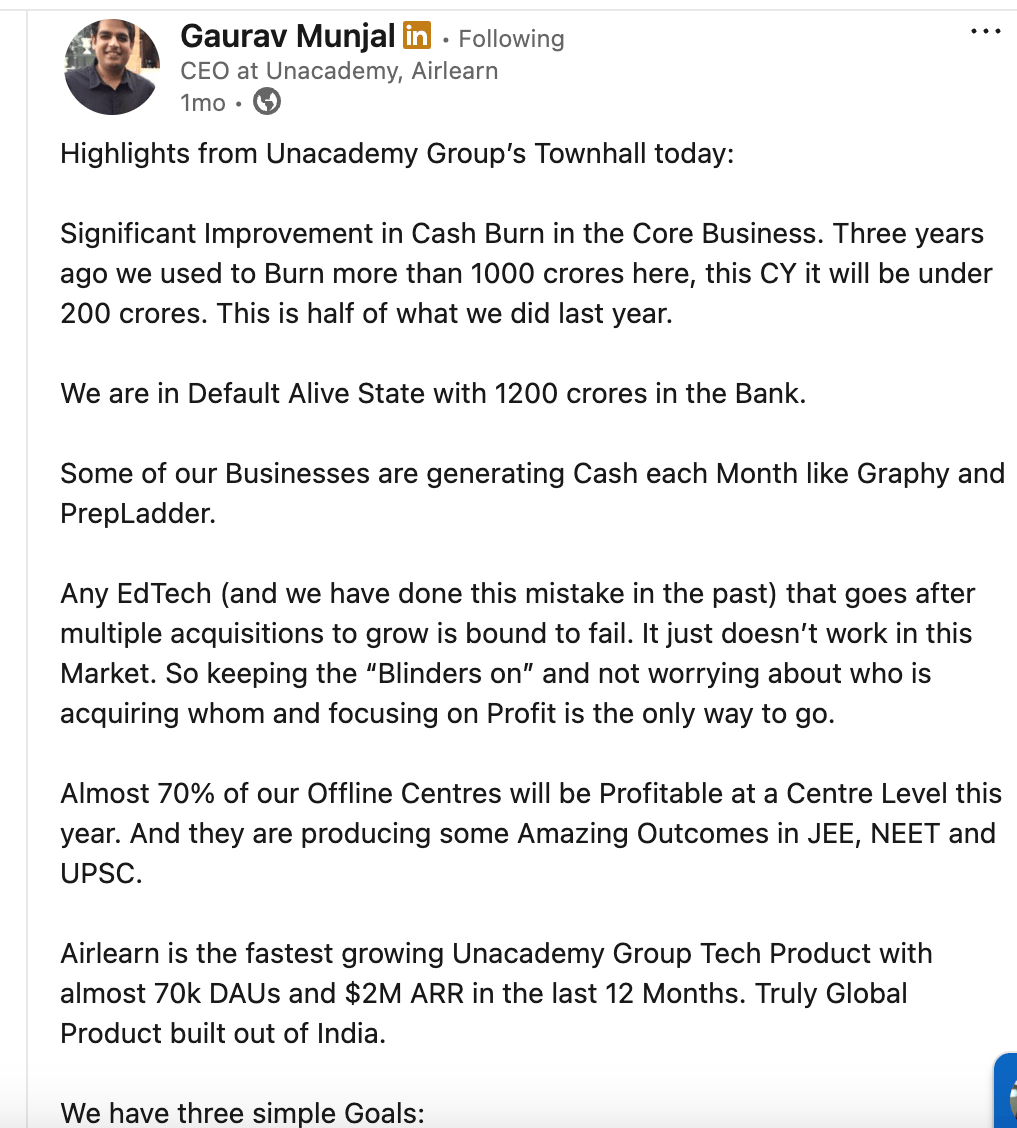

In an April 2025 , Munjal said there was a significant decrease in the company’s cash burn for 2025. “Three years ago we used to burn more than INR 1000 Cr here, this CY it will be under INR 200 Cr. This is half of what we did last year. We are in Default Alive State with INR 1,200 Cr in the bank,” Munjal claimed.

But now, one month later, Munjal has stepped away.

“Munjal is a product guy and hates this offline tuition centre thing,” another source emphasised, adding that he viewed it as a departure from Unacademy’s tech roots. “Munjal’s reluctance to lead this pivot was a key factor in his exit, with the board pushing for a focus on profitability through offline operations, a model better suited to traditional players like Allen.”

No investors or companies were willing to back a $1 Bn exit valuation, given the core business’s losses and the troubles in edtech overall, a source claimed.

Munjal’s focus on Airlearn, a direct Duolingo rival, reflects his preference for scalable, online products. The app is said to have 70,000 daily active users and over 3 Lakh every month.

Airlearn is owned by Unacademy Inc, a Delaware, USA incorporated holding entity for the Unacademy group.

Unacademy’s Product ObsessionThere’s little denying that Unacademy tried to be the everything company in edtech. Even though, in April this year, Munjal posted on social media that edtech startups that go on an acquisition spree are committing a mistake — possibly taking a shot at PW. For context, Unacademy went on aggressive acquisition spree in 2019 and 2020, when it acquired a boat load of companies to tap the pandemic-induced edtech boom.

Today, most of these acquisitions are nowhere in Unacademy’s core or ancillary products. The only ones that carried on were PrepLadder, Relevel (born out of the acquisition of TapChief) and Graphy. Others such as Mastree (acquired for INR 35 Cr), Swiflearn were shuttered soon after the acquisition.

“PrepLadder, Unacademy’s most successful acquisition, generates an estimated INR 200 Cr annually and is projected to grow 50% next year. Yet, its scale remains modest compared to the core business, limiting its impact on the overall valuation,” our sources added.

Relevel was too. Its website is currently inaccessible, even though this represented a big investment on Unacademy’s part. The company poured in more than $20 Mn to scale up the job assessment and hiring platform.

“Relevel’s model was ambitious: candidates passing a test would secure job interviews with partner companies, while those who failed — most did — were upsold bootcamp courses. They scaled fast and screwed up badly,” the insider revealed, noting that Relevel’s revenue model was a failure from the start.

Shashank Murali, who was the TapChief founder and then later led Relevel, has now been tasked with leading Airlearn. “Munjal used Shashank as his guy to tinker and figure out what can work,” the source added.

What’s Next For Munjal And Unacademy?While Munjal has made it clear that his focus will be on Airlearn, can it really stand up to tried and tested rivals such as Duolingo, which has such an ardent user base. It had as of September 2024, and close to 9 Mn paid subscribers.

“Gaurav Munjal is definitely popular among Indian VCs, and has built initial traction around user growth for Airlearn, however, annual revenue of $2 Mn is nowhere close to the multi-billion opportunities that VCs usually chase. What can work in his favour is a massive TAM and the global market, but there has been no serious player from India in the market,” an edtech founder added.

While Sumit Jain has his task cut out at Unacademy — take it to breakeven and then profitability — Munjal is starting afresh. Once again, after three years of struggling to cope with the ground reality for edtech in the post-pandemic era, the founder is back in his comfort zone, building and scaling up a new-age mobile app.

All said and done, it’s the end of the Gaurav Munjal era in Unacademy and India’s edtech ecosystem. Is it the beginning of a new one though?

[Edited By Nikhil Subramaniam]

The post appeared first on .

You may also like

Who was Bernard Kerik? Former NYPD police commissioner and 9/11 hero dies at age 69

Why are white sheets laid in hotel rooms? You will be surprised to know the truth..

PM to visit Kanpur, inaugurate several projects

Nearly 47 pc of digital transactions in India, UPI has gone global: Minister

AI vs Nukes: How China's new tech could shake up global arms control