Three years ago, the founders of ekincare were in a tight spot.

The Hyderabad-based corporate health benefits platform secured $15 Mn (about INR 133 Cr) in March 2022, closing its Series B round at a post-money valuation of INR 298 Cr, per Tracxn data. The round had drawn a clutch of investors such as HealthQuad, Sabre Partners, Ventureast, Eight Roads Ventures, Siana Capital and Endiya Partners. It was the healthtech venture’s first major funding since its $3.6 Mn Series A in November 2019, just months before the Covid-19 pandemic impacted India’s corporate wellness landscape.

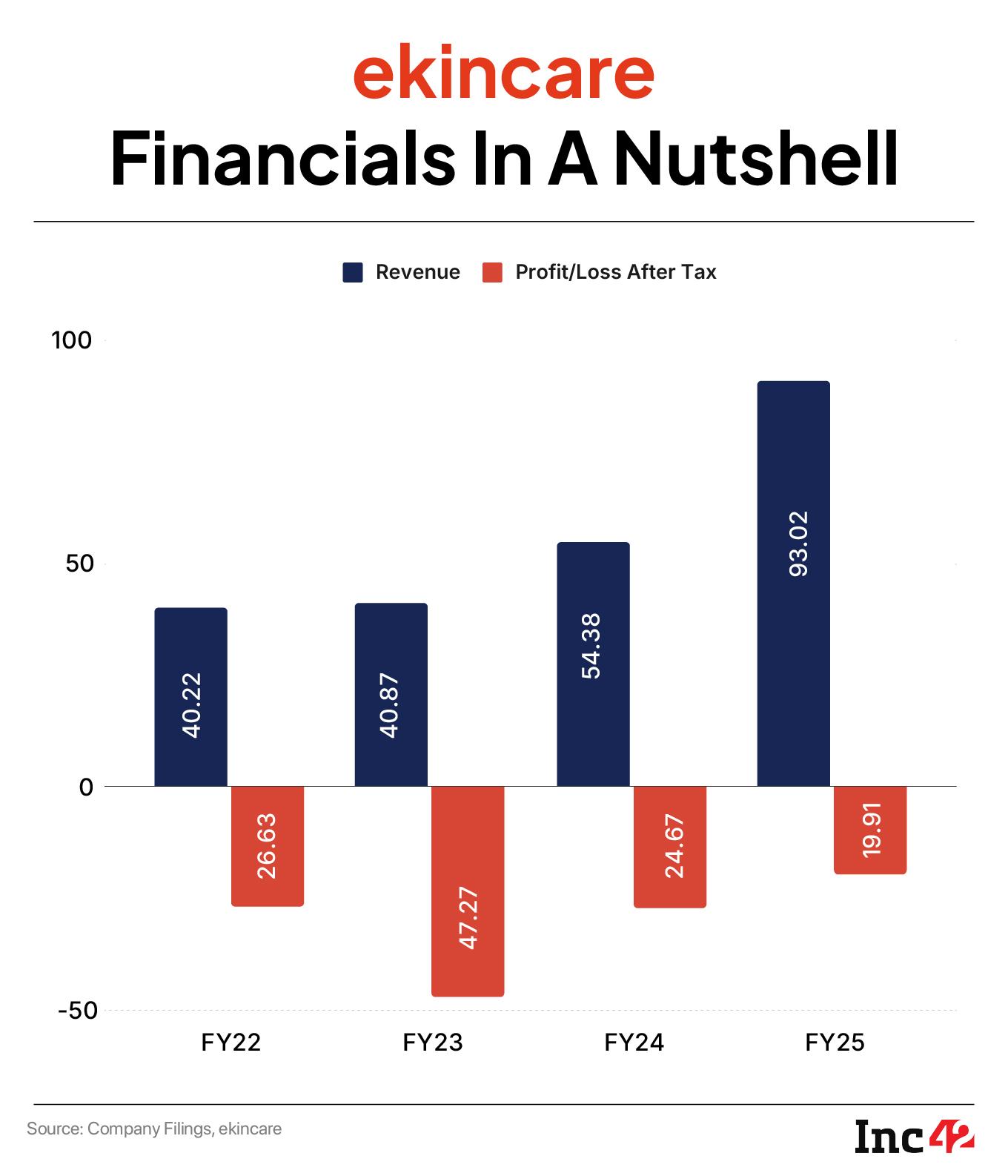

The gap between the funding rounds tested ekincare’s resilience. Its expenses outpaced growth, and net losses shot up. By the end of FY22, its EBITDA margin had turned negative, hovering at -63%. The capital infusion and Covid-induced momentum carried the startup through another year, but the financial situation worsened again. In FY23, the EBITDA margin plunged to -116%.

Early Recognition; No Revenue“Until 2022, the startup ecosystem focussed on growth at any cost. No investor asked about EBITDA or profitability. We, too, were naive enough to stick to growth alone. But from October that year, our focus shifted to sustainable growth, and we prioritised EBITDA,” cofounder and CEO Kiran Kalakuntla told Inc42.

When Kalakuntla set out to build ekincare (“e” for electronic, “k” for kin (friends and relatives), and “care.”) in 2015, he had a clear goal: Build a platform that could analyse all medical records to provide personalised, intelligent health recommendations, a task few had cracked.

Initially, he explored existing tools like Google Health and Microsoft Health Vault but soon discovered these are merely digital filing cabinets. Working alongside cofounders Srikanth Samudrala and Dr Noel Coutinho, Kalakuntla realised that structured and standardised datasets would be required for actionable guidance.

They had no data, though, and no one wanted to share large datasets. So, the team raised their first seed round of INR 1 Cr in January 2015 from Bitkemy Ventures and Adroitent, a company specialising in digital transformation, to collect health records.

“We visited parks in the morning and approached joggers, asking them to try our free app to track their health records,” the CEO recalled.

Subsequently, people snapped photos of their medical documents and uploaded those, feeding the nascent database. The team’s on-ground campaign soon reached radio waves with a catchy jingle: If you use Kindle for reading, Apple Music for songs, use ekincare for medical records. It was old-school hustle driven by digital reach.

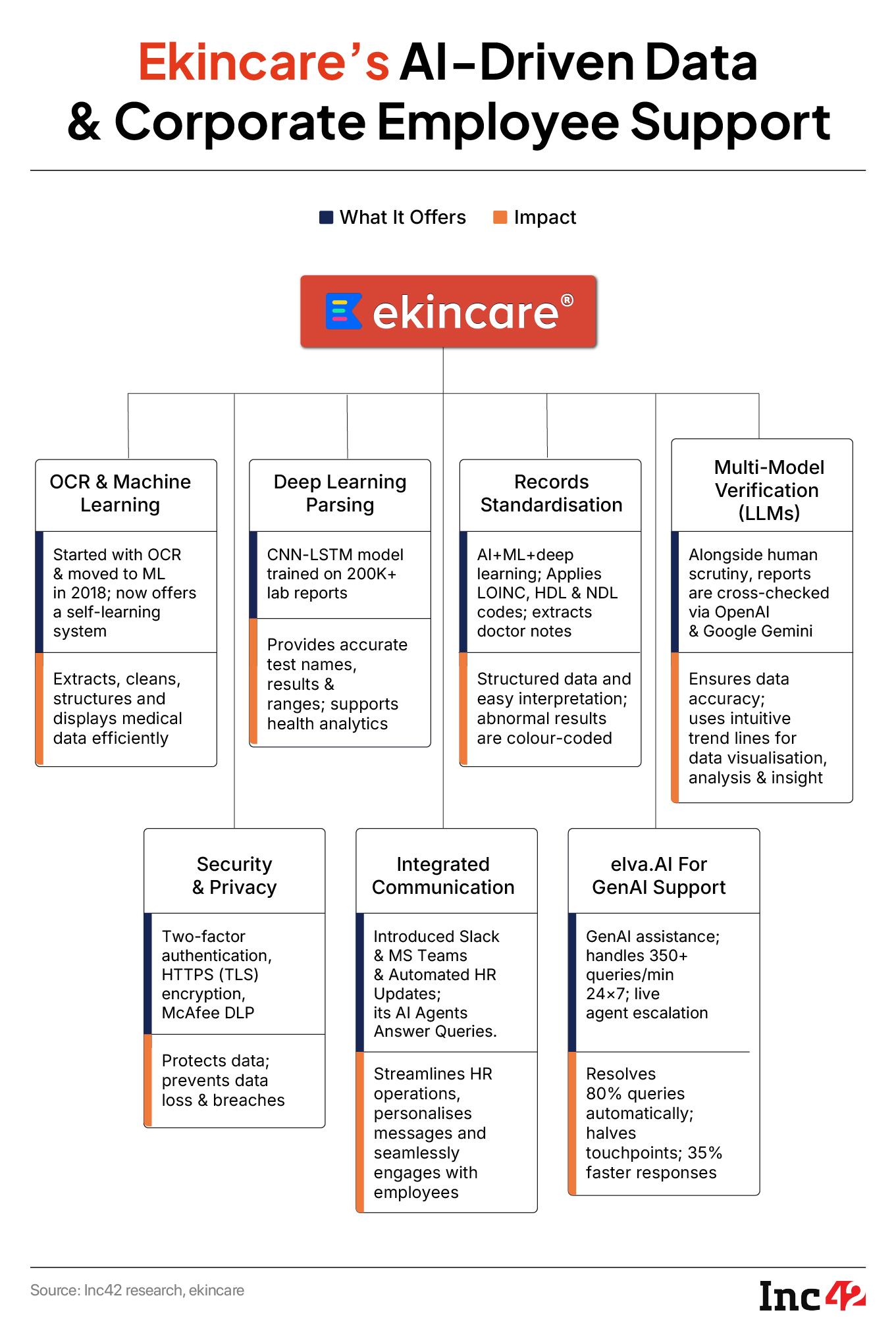

Next came the algorithms. The team began using optical character recognition (OCR) to extract data from medical records. “We extracted the data, cleaned, structured and standardised it so that algorithms could work on top. It took us nearly three years to build those algorithms,” said Kalakuntla. After all, organising the data chaos into something machines could understand and analyse was essential. Starting at about 60% accuracy, the ekincare team pushed relentlessly for greater precision.

Their breakthrough earned a patent for extracting data and providing personalised recommendations. By 2017, the platform had reached 90-95% accuracy. Still, there was no revenue.

When the founders debated their next course of action, a large enterprise approached ekincare to analyse the health records of its 9K employees.

“We did all the work in Excel, ran it through our algorithms, and presented the results in PowerPoint. It was 2018, and we had no apps, nothing at the time,” said Kalakuntla.

“The enterprise had rooms full of medical records across multiple offices and on-site medical rooms. So, we set up large photocopiers in Mumbai, Bengaluru and Delhi to scan records and run those through our algorithm.”

That project earned ekincare its first cheque of INR 15 Lakh. More importantly, it revealed how poorly health data was managed within companies and how much value its solution could deliver to employers. That was why the founders pivoted fully to the corporate segment. “We realised that even if 10 companies were willing to pay for this, it meant the problem was real, and we had the solution they needed,” said Kalakuntla.

The cost dynamics favoured the shift. As a B2B platform, ekincare’s customer acquisition cost can be dropped to around INR 100 per employee, compared to INR 1,400-2,000 in a consumer-centric B2C model. “It means if I can onboard a company with 1K employees, there’s essentially no acquisition cost for me,” the CEO said.

However, the founders knew a standalone health record tracking platform would not be enough to build a competitive moat. As of now, two business models dominate the corporate healthcare space. The first is the routine marketplace model that typically generates a modest revenue stream. The second, and more sustainable revenue driver, is underwriting, where companies buy bundled service packs at predetermined rates. The latter requires managing risk and forms a solid revenue foundation.

To strengthen its position, ekincare built a partner network and began offering bundled packages that included preventive health screenings through certified centres, telehealth consultations, mental health counselling, medicine delivery and more.

Earlier, employees often visited diagnostic/medical centres independently and submitted their invoices, creating a co-ordination tangle and operational bottleneck for companies managing large workforces. So, ekincare built an employee-facing application, ensuring a streamlined way to book appointments, while consolidating hundreds of healthcare providers and managing standardised payments across 550 cities. In essence, it acts as a single point of contact for bookings, fees and escalations, making healthcare management seamless for corporate houses.

Quest For Sustainable GrowthThe startup grew rapidly, from 10 corporate clients in 2018 to 100 by 2019 and 400 by 2022. But as the client base expanded, so did the burn rate. By the end of FY23, losses mounted despite growing revenues (a close look at its financials later).

Industry analysts told Inc42 that the corporate wellness market in India underwent a sharp change after Covid-19. Before the pandemic, most players focussed on primary healthcare, with benefits kicking in only when employees fell ill. Post-Covid, the pendulum swung to preventive healthcare.

The shift was fuelled by IRDAI regulations mandating health insurance for all employees, reducing permanent illness exclusions from 30 to 17 and expanding coverage of mental and behavioural health. These regulatory measures empowered insurers and prompted platforms like ekincare to expand their offerings, adding gym, yoga, wellness coaching and nutrition programmes.

Today, the sector is more crowded than ever. Specialist intermediaries such as ekincare, FITPASS, MediBuddy, HealthifyMe, TruWorth Wellness and Trijog built their businesses around employee health programmes. But the niche they carved out attracted heavy competition. Local and global insurers, employee benefits platforms such as Onsurity and Pazcare, and employee engagement companies like Wellable, Vantage Fit and Stepathlon entered the space, drawn by its growth potential. HRtech firms like Rippling, ADP Workforce Now, Gusto and Paylocity also developed wellness products.

The outcome is a fiercely competitive battleground to capture enterprise clients. Margins are squeezed and per-employee revenue decreases, even as the market grows. As one analyst observed, “The sector remains highly fractured, with limited product differentiation and uneven employee engagement. Few companies have succeeded in turning user activity into profitability.”

Consider this. MediBuddy (which spun out of MediAssist as an independent entity) reached the INR 600 Cr+ revenue mark in FY24, which involves a larger support by its incubator Medi Assist. In contrast, GetVisit, a smaller player, struggled to cross INR 120 Cr even after it was acquired by Zydus, a leading pharmaceutical company (formerly Cadila Healthcare). Companies without proprietary products or customised solutions remain dependent on larger partners, limiting their ability to scale or sustain operations.

For aggregators and specialised intermediaries, client retention remains an uphill task. In fact, many players accept suboptimal terms to stay afloat. Multiple platforms often court the same corporate client or network partner. For instance, two players may approach the same company. However, one of them, leveraging its scale, can negotiate on volume and offset certain conditions to close a deal.

“This leads to aggressive undercutting and ‘internal bloodshed’ within the ecosystem,” another analyst said. “It erodes the stability and distinctiveness of intermediaries, making revenue growth elusive even for established players.”

Meanwhile, ekincare was passing through a difficult phase. By October 2022, investor capital was running low. With mounting losses in two consecutive financial years (FY22 and FY23) and competition intensifying, the founders decided it was time for a hard reset to stabilise operations and regain momentum.

Over the next year, they overhauled internal processes, trimmed costs and reoriented the business towards efficient growth, as we will see in the next section.

The healthtech startup ended FY24 on firmer ground. Revenue grew by 33% to INR 54.38 Cr from INR 40.87 Cr in the previous fiscal year, and net losses halved to INR 24.67 Cr from INR 47.27 Cr.

The momentum carried into FY25. Its revenue nearly doubled to INR 93.02 Cr and losses narrowed further to INR 19.91 Cr. However, Inc42 could not independently verify the FY25 numbers, as the company filings for that year were not available.

Now, ekincare serves more than 1,400 enterprise clients such as Capgemini, GSK, BlackRock, Toyota, McKinsey and KPMG, supported by a network of 50K+ healthcare service providers. On the platform, an average of 32% of employees are active every month, and roughly 60% of its health and wellness programmes see enrolment, as claimed by the founders.

Internally, the startup has reinforced its leadership and recently promoted Somak Ray from vice-president of operations to cofounder to spearhead ongoing growth and operational excellence.

“This year [FY26], we aim to grow another 60-70% and become an EBITDA break-even company,” said Kalakuntla.

Inside The Strategy: How Ekincare Navigated A Crisis

Inside The Strategy: How Ekincare Navigated A Crisis Facing steep losses and increasing competition, ekincare’s founders realised that a turnaround would require more than incremental fixes. Every aspect of the business — from partner relationships and technology to cost structure and workforce strategy — had to be rethought.

What followed was a carefully orchestrated series of moves that stabilised operations, strengthened revenue streams and laid the groundwork for sustainable growth.

Minimum infra costs: Since the healthtech platform operates entirely through partners (such as Tata 1MG for medicine delivery, Cult and Fitpass for gyms, and Orange Health Labs for diagnostics), it owns no physical infrastructure. Instead, it runs a managed marketplace, integrating services from labs, pharmacies, fitness centres and wellness providers into a unified system. This co-ordination, though seamless for users, adds to the startup’s technical and operational costs. Ekincare collects fees, retains its margin and remits partner payments for hassle-free operations.

Reliable revenue flow through subscriptions: The platform charges corporate clients per-employee basis and typically works with organisations with at least 500 employees. With around 400 clients, ekincare collects annual fees covering more than 2 lakh employees. This ensures a steady revenue stream that helps cushion volatility and cash crunch.

Winning partner confidence: Interestingly, partner networks have started to recognise the growing importance of intermediaries in the corporate wellness ecosystem. According to an industry leader, who has collaborated with several players like ekincare, intermediaries play a key role in rapid deployment.

For example, large corporations often require lengthy legal contracts and still favour quick, ready-to-implement solutions. In such cases, intermediaries provide quick access through apps or systems, helping bypass administrative delays.

“Service providers with lean B2B teams often rely on distributors to manage client relationships, procurement and operations while they focus on pricing and products. Thus, distributor-led models provide efficiency and profitability,” CEO added.

Using tech to stay lean: For ekincare, salaries posed the biggest challenge, consuming nearly 70% of its fixed costs. As losses deepened in FY23 and survival became uncertain, the startup made a difficult decision and reduced its workforce by half, from 320 to 160. The drastic reduction meant technology, particularly AI, had to take over routine tasks, putting automation at the centre of operations. Currently, nearly 25% of its payroll goes to the technology team, says Kalakuntla.

New Lifeline, Old Challenges: Are Troubles Still Brewing At Ekincare?

New Lifeline, Old Challenges: Are Troubles Still Brewing At Ekincare? The healthtech platform’s latest financials show signs of stabilisation, but capital remains a stubborn hurdle. The pandemic brought corporate wellness programmes into focus, prompting more companies to invest in employee health. Yet investor confidence has lagged behind corporate uptake.

“One in three companies spends on employee health and wellness, yet many investors remain sceptical,” said Kalakuntla. A few forward-thinking funders have backed ekincare. Still, it continues to draw less attention than B2C players like PharmEasy or Tata 1MG.

Earlier, workplace wellness was a niche segment, although it was a point of pride for HR departments worldwide. Across offices, employees were flooded with wellness options — mindfulness courses, resilience training, sleep apps, even midweek massage classes — and a new vocabulary of care emerged.

This perspective is gradually taking hold. In April 2025, MSD, a 130-year-old global biopharmaceutical company, made a strategic investment in ekincare through its IDEA Studios (Asia Pacific) initiative. Although the deal value was not disclosed, the round saw strong backing from HealthQuad, an India-based healthcare VC fund and an existing investor in ekincare. In 2022, MSD also led commitments for HealthQuad’s $162 Mn Fund-II as an anchor limited partner. The investment signals that the pharma major’s interest in India’s healthtech ecosystem runs deeper than a single bet.

Analysts view the April deal as a win-win. For cash-strapped ekincare, the MSD round provided a much-needed lifeline when capital was scarce. For the pharma giant, it offered a way to test the waters for deeper collaboration and broader growth opportunities.

As ekincare’s strength lies in its data-rich platform and extensive network of service providers, it can be a powerful tool for a pharma partner seeking insights into R&D, preventive care and disease management. If the startup achieves adequate scale, it may support MSD’s growth plans, providing access to patient behaviour data and early health touchpoints in India.

However, according to analysts, successive funding rounds also lead to heavy equity dilution, further eroding founders’ long-term incentives and strategic control. These dynamics can accelerate investor pressure for early exits, often before a company’s fundamentals are strong enough to sustain those.

Besides, investors are wary of platforms that operate purely as intermediaries, without proprietary products or a defined edge. Given their limited differentiation, that model leaves companies more vulnerable to competition and price battles.

The market structure complicates matters further. India’s corporate wellness market mirrors the insurance sector, where brokers dominate, and many HR teams rely on them to design and manage benefit programmes. This reliance stems less from a lack of capability and more from limited access to information and hands-on implementation. As information gaps narrow, intermediaries may lose much of their relevance.

What’s Next For Ekincare: Value-Driven Growth Or Redundancy?For now, MSD’s strategic investment may have given ekincare some breathing space. Nevertheless, questions regarding its business model and long-term growth may not go away soon.

In spite of persistent challenges, the founders of ekincare remain optimistic about the corporate wellness sector. Industry estimates suggest that more than 70% of Indian businesses invest in wellness programmes, promoting healthy lifestyles and improving employee engagement. Better still, these programmes are no longer confined to basic health checks. They have evolved into structured offerings encompassing counselling, fitness, nutrition and preventive care, all aimed at reducing absenteeism and long-term healthcare costs.

Although corporate wellness in India has gathered momentum, the market remains at an early stage. At home, the market size is projected to reach $1.6 Bn by 2025 and grow to $3.3 Bn by 2033, a small fraction of the $112 Bn global market (by sales revenue).

With an estimated potential of $7 Bn (as shared by ekincare), roughly 4% of India’s $170 Bn preventive healthcare market, this sector offers headroom for growth.

For managed marketplaces like ekincare, these dynamics present both opportunity and challenge. Their strength lies in a collaborative model that connects diverse healthcare verticals — from fertility and eye care to vaccination — within a single system. Large corporate houses like KPMG (an ekincare client) and their employees find this architecture appealing, as it provides a unified experience, streamlines benefits management and enables strong, data-driven decision-making.

Plus, these platforms can be key enablers of preventive healthcare due to real-time insights across health parameters. Ekincare’s partnership with MSD on HPV vaccination is a case in point. While specialists gain access to millions of employees and scale public health outcomes, employees benefit from higher awareness and greater adoption, reinforcing the commercial relevance of healthcare and healthtech.

In line with overall growth, ekincare is piloting its first cross-border expansion, initially targeting Malaysia, Indonesia and the Philippines. The startup will focus on OPD (outpatient department) benefits, providing employees and employers with a seamless, cashless experience.

It is also developing elva.AI, an intelligent health companion designed to interpret medical records, track health patterns, and deliver context-aware, data-driven guidance that supports preventive care.

On the flip side, these opportunities come with stubborn structural challenges that complicate scaling and long-term value creation.

During the pandemic, every business worth its salt rushed to launch digital platforms and mobile apps. Features that once differentiated a company are now table stakes, and domain-specific service lines have blurred. Insurers roll out increasingly sophisticated digital products. Hospitals bundle multi-speciality wellness services through their TPA networks and industry relationships.

Even healthtech startups and wellness platforms are experimenting with AI-driven coaching, gamified engagement and niche preventive-care offerings, creating a crowded and diverse competitive environment. Simply put, the competitive landscape is shifting rapidly, intensifying pressure on intermediaries like ekincare and making sustainable growth even more challenging.

Nevertheless, the market continues to expand, marked by steady growth, low churn and ample space for multiple players to scale. In this evolving market, the real edge lies in the innovative applications of core technologies. Sustainable growth depends less on digital tools and more on proprietary products that deliver measurable value to businesses and consumers.

For ekincare, the ability to stay ahead depends on three key factors: Differentiating its offerings, strengthening partnerships and ensuring its data-rich platform provides tangible outcomes competitors cannot easily match.

[Edited by Sanghamitra Mandal]

The post Ekincare Built A Corporate Wellness Ecosystem; Will Profitability Follow? appeared first on Inc42 Media.

You may also like

John Wayne given 'best advice of my life' in foul-mouthed rant on classic movie set

French luxe retailer Galeries Lafayette set for India entry

Apple Lobbying Centre To Relax Income Tax Laws

'Mera Booth, Sabse Mazboot' not just a programme but strongest link in BJP's success at grassroots: PM Modi

India lose 2–4 to Australia at Sultan of Johor Cup 2025